Finding the right data for development – the challenge of intangible capital As we begin 2015, the year the United Nations Millennium Development Goals (MDGs) expire, development is increasingly about our more-than-Northern and more-than-human world. This is a world of globalisation, increasing interdependence and intertwining of society and nature. In this context we can easily imagine that the truism “what is not measured is not managed” holds true. We cannot run a system, nor evaluate it, without data. But what kinds of data do we have and what kinds do we want to inform governance, institutional arrangement and managerial practices. More often than not best practice in policymaking and international development demonstrates that quantitative data is better or easier to work with than qualitative. But this isn’t necessarily the case.

A telling example of how the “right” numbers can enact a politically tangible reality in need of intervention is the case of biodiversity hotspots – illustrated in figure 1.

Figure 1 | source: “Biodiversity hotspots for conservation priorities” by Myers et al. 2000; Nature.

Biodiversity hotspots are regions of the world that contain an extraordinary number of endemic animal and plant species at risk. Other theories that foreground the role of species quality instead of species quantity have come up short on policy-friendly figures, thus making “hotspots” the hot world view to turn to when politicians and policymakers set out to preserve biodiversity. The focus onbiodiversity hotspots serves as a tractable illustration of environmental risk and thus shows policymakers what they should prioritise.

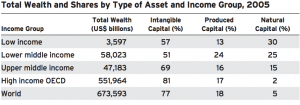

To give another, and perhaps more controversial example, figure 2 illustrates the main differences in wealth between different supra-national income groups. Here the World Bank also produces a quantitatively inspired view of the world.

However, the World Bank’s main take-away from this table is the predominance of intangible capitalwithin each region. Intangible capital is determined by subtracting all physical, natural and net financial assets accounted for in the measure of total wealth. The World Bank defines what remains as “all nonphysical, nonfinancial assets”, such as human, social and/or institutional capital. In other words, intangible capital accounts for all the economically significant but unquantifiable socio-cultural “stuff”.

Omitting the details of these estimates, it’s important to note that there is a strong positive correlation between intangible capital and total wealth. This indicates that intangible capital such as education, general social trust and (good) institutions of governance contribute significantly to the efficient use of physical, natural and net financial assets, leading to increases in wealth. Traditionally the World Bank has estimated wealth in measures of produced assets (i.e. physical capital), but measures of natural capital, human and institutional resources (i.e. intangible capital) are steadily being incorporated into the organisation’s assessment of a nation’s wealth. The Human Development Index is a prominent example of a measurement that focuses on levels of human capital.

The search for new development indicators and ways to identify, represent and support the socio-cultural qualities of intangible capital raises an interesting challenge for low-income countries, where intangible capital only accounts for 57 percent of the economy. Compared to levels of intangible capital in OECD countries, which stands at 81 percent, it becomes clear that there is scope for socio-economic discovery and development of intangible assets. This change in approach is occasionally ignored by day-to-day development policies that are geared according to quantitative measures of success.

The importance of intangible capital to high performance economies strongly indicates that not everything that counts hasbeen counted. New ways of determining and leveraging intangible capital are needed for a kind of development that is based on fairer representations of the world. That is, representations that include increasingly intangible but ostensibly significant factors. Mapping these factors and translating them into something that makes sense for policy professionals is a key challenge for the 21st century. This is essentially a question of using quantitative and qualitative methods, or a so-called mixed-methods approach, to inform policymaking and development. In short, we need to make qualitative data count. The debate is as relevant as ever since quantitative measures remain the most economically efficient and the easiest to standardise.

The growing demand for evaluation measures that are sensitive to environmental, social and governance (ESG) factors presents an important opportunity for interdisciplinary research. Indeed, interdisciplinarity is a tired term. However, it remains important to underscore that different and often local forms of expertise are necessary for the development of more adequate indicators of ESG performance. These indicators, in turn, are crucial for sustainable socio-economic development.

ESG-oriented reporting mechanisms are accompanied by a growing number of investment indices and close-to-the-ground advisory services that promise to advance investments in more sustainable services and technologies. Equally as important, large institutional investors are looking for opportunities in the impact investment market targeting assets that generate a ‘measurable’ positive impact. Such efforts should help accelerate broad-based prosperity across the globe. Notwithstanding, the growing number of rating agencies and various “standards” shows a continued need for methodological innovation.

While an entire market is being created around the abundance of data in high performance economies, the lack of reliable data in developing countries makes it difficult to measure their actual and potential development. Whether intangible capital is measured and taken into consideration by consultancies, who devise plans for development, depends on the availability of data that falls within the framework of the models mobilized by the same professionals. Accessing such data is fraught with practical obstacles, such as the public’s willingness to partake in research and volunteer data. Meanwhile contemporary efforts to overcome such obstacles in the name of progress and prosperity are faced with difficult ethical debates about Euro-American imperialism and competing interpretations of what development is or how it should be realized.

The indicators we use today have proven unable to asses all kinds of development, and understandably so, if we take into consideration their origin in time and space. This reiterates the constant need for professionals who make it their first priority to shine a light on the multitude of economic intangibles that contribute to economic growth as well as social and environmental prosperity.

Methods are crucibles for understanding and shape the manner in which societies and natural habitats are cared for. We should continuously think about the diversity that escapes the models used for analysing and measuring development. As a new era for development is set to begin after the 2015 Millennium Development Goals, the time is right to think about how economically significant but intangible assets can be given a more prevalent and defining role in the realm of policy making and amongst development professionals in the public and private sector. The answer is not simply to collect more data on a wider range of issues. We need to innovate our data-collecting tools and channel resources towards social innovations that make economic intangibles count. Harnessing a combination of qualitative and quantitative data would be a step in the right direction.