This election is looking increasingly confused. With each side unable to gain a stable lead and a hung parliament looming on 8th May, the two main parties are desperately trying to court voters from the centre ground. It is no surprise, then, that for the voters, the parties’ policies seem increasingly hard to discern from one another. Indeed, this week’s IFS report criticised all the main political parties for failing to provide a clear account of their economic plan, none adequately outlining how much they intend to spend, borrow and cut.

Whilst the Liberal Democrats attempt to hold the middle ground, preferring to advertise their apparent credentials as the moderator of two extremes and their post-election strategy, as opposed to discussing what precisely it is that they stand for, the two main parties have, increasingly, seemed to be dressing in each other’s clothes.

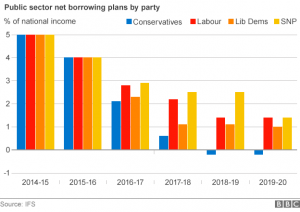

However, contrary to how things may superficially seem, this election does present a real choice, a choice between two very ideologically different plans for the economy and the country as whole. As the same IFS report clearly shows, there is a marked difference between the economic plans. Labour announced their intention to reduce spending as a percentage of national income, but to do so at a much less aggressive rate than the Conservatives, who would continue at the current rate for the majority of the next parliament. The necessary cuts to achieve that goal would be dramatic. Labour, on the other hand, believe that reducing the deficit will be easiest and most comfortably achieved through an increase in economic growth, which would require an increase in production and therefore jobs and a programme which is, of course, hindered by public spending cuts. Indeed, the greater the growth of the economy, the greater the wealth produced and therefore less spending cuts would be necessary to achieve deficit

It is on this basis that Labour have designed their policies. Ed Miliband has presented plans to give anyone working on a ‘zero hours’ contract for more than 12 weeks the right to a full time contract. The aim here is to remove the employment uncertainty which hinders workers on such contracts, making it difficult to afford monthly bills and mortgages. As such, employers would still initially be able to offer zero hours contracts, and workers with variable schedules could work under those terms indefinitely if they so wished, but for those who wanted or needed a reliable income, the exploitation they face at the hands of some companies, would be ended.

Undoubtedly a crucial part of an incoming Labour government’s job would be to reverse a number of the detrimental changes made to the Welfare State and NHS. The unpopular ‘bedroom tax’ would be repealed immediately, lifting a tax on vulnerable people, many of whom are not even be able to move to smaller occupancy homes due to the current lack of social housing and are consequently enduring a disproportionate and unfair tax burden; the Conservative pledge to reintroduce the ‘right to buy’ scheme would surely not relieve this problem.

Further, the Health and Social Care act would be repealed, ending the increasingly dangerous privatisation of services Indeed, NHS England have published a report on the projected shortfall in funds in the next parliament, which further outlined the overhaul of services that would be necessary to maintain the Health service in its current form. The spectacular failure of privately run hospitals such as Circle Hinchingbrooke and care homes to provide adequate services illustrates the negative impact of privatisation which has allowed companies to chase profits, to the detriment of the quality of healthcare provided.

Labour have, of course, made it clear that such spending increases need to be paid for without increasing public borrowing. Rather than targeting the most vulnerable in society, however, a that not only hinders social equality but also fails to collect the necessary tax revenue, Labour plans to implement more fairly distributed tax changes. Many, particularly those in London who have profited from soaring house prices are concerned about the proposed ‘mansion tax’, a levy on private property worth over £2 million, which is projected to raise £1.2 billion. When one looks at the facts, this policy can’t seem like a bad idea. The fact that rich oligarchs investing in premium property pay the same council tax as residents, cannot possibly be fair. The owner of a £140 million flat bought in Westminster, for example, is due to pay the same council tax of £26 a week as the average property owner in the area. Out of over 26 million homes in the UK, Just 100 000 will be subject to the tax, of which 87 000 are in London.The main objection put forward is that for the asset rich and cash poor this tax could become prohibitive, and force them to sell. – Older people , for example, who have lived in their home for many years and watched its value increase, but are without an income reflecting the value of their property, might be hit particularly hard. Labour, however, have stipulated that those earning less than £42, 000 a year to would be allowed to defer payment of the tax` until the sale of their property . At a time when so many young people are just struggling to get onto the property ladder at all, and others finding it difficult to repay their mortgage, taxing those who have profited from rising house prices seems a just and reasonable idea Labour have further proposed to abolish Stamp Duty for first time buyers, a policy that would lift a significant tax burden and has the potential to make a real difference to those considering a potentially large mortgage or struggling to find a deposit.

Another means of raising funds would be to bring back a rise in the top rate of tax, so that those earning over £150000 would pay the 50p rate, as well as abolishing the non-dom tax status, which currently allows wealthy individuals to manipulate their way out of paying UK taxes. By virtue of such measures, Labour will be able to re-introduce the 10p lowest rate of tax to reduce the tax burden for those on a lower income. Labour also seeks to reduce the wage gap between the lowest and highest earners by raising the minimum wage to £8 an hour, a figure that is closer to a living wage, as recommended by the living wage foundation promote gender equality in the workplace Labour intends to companies to publish wages, to highlight and subsequently reduce the wage gap between the genders. Furthermore, to ease the pressures on working parents Labour have pledged 25 hours per week of free childcare for parents of children aged 3-4, and guaranteed access to childcare from 8am-6pm,

Yo ung people have been hit particularly hard by the recession, with youth unemployment levels extremely high. Degree inflation has complicated things further, since an undergraduate degree, which now is accompanied by a huge burden of debt, is no longer enough to secure a graduate job. As such Labour intends to provide other avenues into work for young people, by introducing and encouraging technical degrees to promote industry, benefiting young people and the economy, as well as guaranteeing apprenticeships for school leavers and banning unpaid internships that last longer than 4 weeks. After the extraordinary let down of the rise in tuition fees, young people in this country feel increasingly abandoned by politics and the preceding generation, who profited from free education and a thriving jobs market only to deny the the same opportunities. Labour intend to address this issue with by reducing university tuition fees to £6000 per year.

ung people have been hit particularly hard by the recession, with youth unemployment levels extremely high. Degree inflation has complicated things further, since an undergraduate degree, which now is accompanied by a huge burden of debt, is no longer enough to secure a graduate job. As such Labour intends to provide other avenues into work for young people, by introducing and encouraging technical degrees to promote industry, benefiting young people and the economy, as well as guaranteeing apprenticeships for school leavers and banning unpaid internships that last longer than 4 weeks. After the extraordinary let down of the rise in tuition fees, young people in this country feel increasingly abandoned by politics and the preceding generation, who profited from free education and a thriving jobs market only to deny the the same opportunities. Labour intend to address this issue with by reducing university tuition fees to £6000 per year.

Finally, a vote for the Labour Party is first and foremost a vote for fairness. Whether this refers to health, social care, childcare or employment, a Labour government’s commitment is to increase opportunity and prosperity for all. The economy is, of course, crucial to this; but harsh spending cuts inhibit growth – as George Osborne found out in the first 2 years of this Parliament – and growth is the key to economic success and to an increase in living standards. Starkly put, it’s about putting the needs of the many and the most vulnerable over the needs of the wealthy few.